One of the most frequent topics during my client meetings for the past few years has been interest rates and how low they have been. I often get asked questions like, “How much longer will interest rates remain low?” and “Do you expect mortgage rates to rise?” There are many arguments for rising interest rates in the US, but I personally think interest rates will remain low for a long time to come.

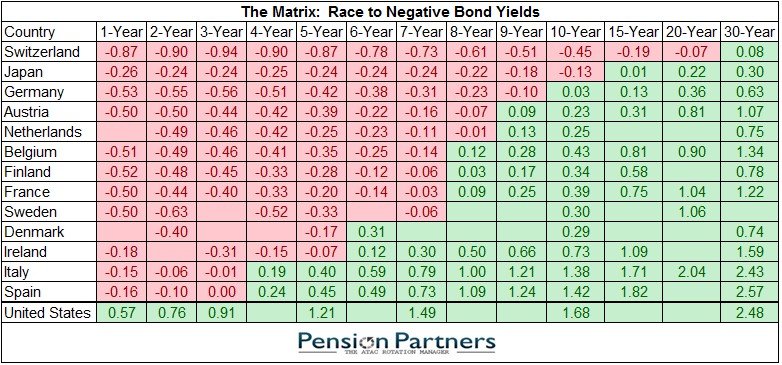

My case for continued low rates is based in my belief that foreign nations and people will continue to buy US Treasury Bonds with high demand. Why will our bonds be in high demand versus the rest of the world you ask? Simply because US Treasury bonds offer some of the highest yields in the entire developed world right now!!! If you look at this graphic below from June of 2016, you can see that United States bond yields are not only higher than a majority of developed countries, but that several countries even have negative yields!

What makes this even more fascinating to me, is that economically weak nations are paying less interest than the US. If I were to personally go out and buy a bond from Italy, I would expect to receive a higher interest rate to compensate me for the additional risk that a weaker economy like Italy might not pay me back. I would think that the US bond yields would be lower than Italy’s due to the low risk of the US defaulting on a debt payment. However, that is simply not the case! The above graphic shows how Italian bonds are viewed as ‘less risky’ than US bonds, which is comical to me. How did this happen? The European Central Bank has intervened in the debt markets and purchased member nation bonds to drive down their interest rates. In order to explain how that works, let me give an example:

Hypothetically, a bond goes up for auction that is a $1,000 bond with a 5% interest rate. That means the bond will pay $50 a year irregardless of price. If many people want to buy the bond, the price goes up due to demand. So let’s say the bond ends up selling for $1,100, but the interest earned is still just $50 a year. This makes the effective interest rate go from 5% to 4.5% ($50/$1100)

So in looking at how the US bond yields are some of the highest in the developed world, it would seem to make sense that people would want to buy our bonds to earn a higher interest rate. As people buy more of our bonds, it keeps the interest rates low due to high demand (as explained above). Therefore, I think I have a decent case for continued low interest rates here in the US. Also, mortgage rates tend to be tied to the yield of the US 10 Year Treasury Bond. So if the 10 year yields are driven lower, you will see mortgage rates decline as well.

The next obvious question on my mind is, “When will this end and interest rates start to rise?” I unfortunately have no idea. The level of intervention in the capital markets by central banks and governments around the world is unprecedented and all anyone can do is hypothesize about what could happen. I just simply expect rates to be very low for the foreseeable future and maybe even decline from current levels here in the US. I’m sure I’ll write a blog in the future about how this all ended and I don’t think it will be good news…